Top-Performing Equity Markets of 2024: U.S. Leads Global Surge

Varun Mourya

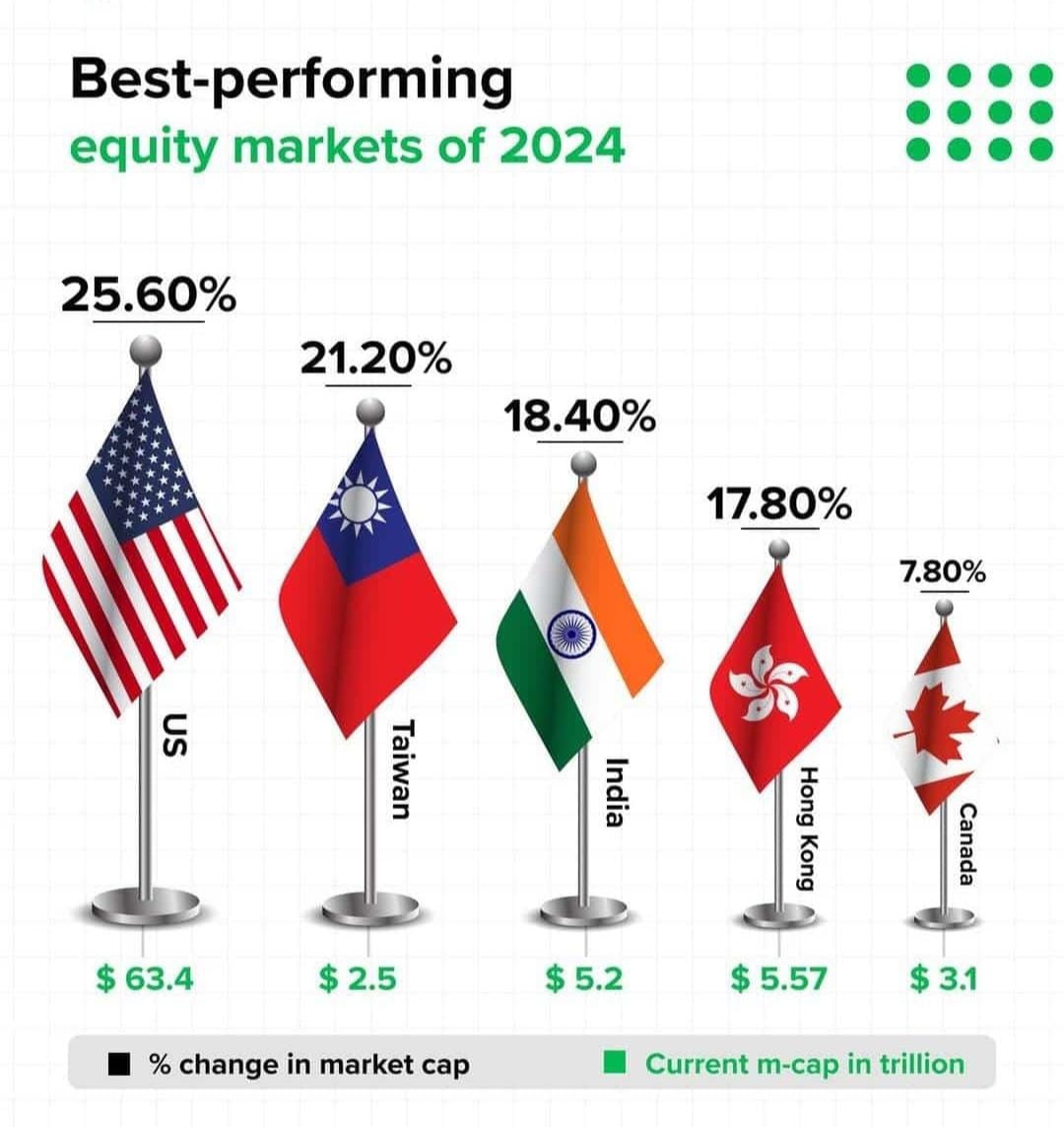

The year 2024 marked a strong performance for global equity markets, driven by a combination of economic resilience, technological advancements, and investor confidence. Among the top performers, the United States led the pack with a remarkable 25.60% growth in market capitalization, showcasing the strength of its economic fundamentals and thriving corporate sector.

Performance Breakdown of Leading Equity Markets

1. United States:

Market Growth: 25.60%

Current Market Capitalization: $63.4 trillion

The U.S. market’s growth was fueled by robust gains in the technology, healthcare, and energy sectors, alongside a strong consumer market.

2. Taiwan:

Market Growth: 21.20%

Current Market Capitalization: $2.5 trillion

Taiwan’s growth was driven by its dominance in semiconductor manufacturing and sustained global demand for advanced chips.

3. India:

Market Growth: 18.40%

Current Market Capitalization: $5.2 trillion

India’s equity market growth stemmed from strong domestic consumption, infrastructure development, and favorable government policies aimed at boosting investment.

4. Hong Kong:

Market Growth: 17.80%

Current Market Capitalization: $5.57 trillion

Hong Kong’s performance was bolstered by its role as a gateway to Chinese markets, despite global economic challenges.

5. Canada:

Market Growth: 7.80%

Current Market Capitalization: $3.1 trillion

Canada’s growth reflected stability in its banking and energy sectors, though it lagged behind other major markets.

Key Drivers of Market Growth

The year saw a resurgence in global investor sentiment, supported by:

Macroeconomic Recovery: Major economies showed resilience amid moderating inflation and interest rate adjustments by central banks.

Technological Innovations: Advancements in AI, renewable energy, and digital transformation acted as catalysts for market growth, particularly in the U.S. and Taiwan.

Government Initiatives: Strategic reforms and policies, especially in emerging markets like India, played a significant role in attracting foreign investment.

Outlook for 2025

With the U.S. leading the charge, global equity markets appear poised for further growth in 2025. However, geopolitical tensions, monetary policy shifts, and economic uncertainties could pose challenges. Investors are expected to focus on sectors like technology, green energy, and healthcare, which continue to drive global equity momentum.

( data as of December 26, 2024)